RONKONKOMA, NEW YORK — Because of the coronavirus (COVID-19) outbreak, many small businesses have been forced to scale back their hours of operation, encourage its employees to work from home and offer paid time off. Between these actions and the ongoing health crisis, they are seeing their profits shrink and their cash flow dry up.

One concern the public has in patronizing retail businesses is having to make physical contact with payment devices. This includes touching a keypad to enter a PIN after using a debit or credit card, signing on a touchscreen using one’s finger and receiving paper receipts. To address this, MBPS has an array of contactless and mobile devices for merchants to accept payments from vendors and customers to help them stay in business. These include the SwipeSimple Register, the iProcess™ Mobile Application, Electronic Invoicing, the Clover® Go Contactless Reader and the Clover® Flex.

The SwipeSimple Register is a user-friendly payment collection system that is available in countertop and on-the-go solutions. The SwipeSimple countertop features a Swift B250 card reader, a Swift B250 charging stand, an mPOP cash drawer and receipt printer. The on-the-go option has a Swift B250 card reader and an SM-L200 receipt printer. It is ideal for general retail and specialty stores, food and beverage service businesses, salons and spas. Key features include an integrated cash register and payment acceptance package, cloud-based inventory and item tracking, Web-based reporting and electronic signature capture.

A mobile version is available for SwipeSimple customers at no additional cost. This allows companies to accept payments from repeat customers without collecting credit card information every time and saves customer data, cards on file and scheduled payments. This solution is ideal for doctor’s offices, lawyers, accountants, home and repair services and more.

The iProcess Mobile Application works seamlessly with the iPS Enterprise Encrypted Mobile Card Reader and provides retail establishments flexibility and convenience to accept credit and debit card payments anywhere by phone or tablet. It supports Apple- and Android-based devices and is free to download. Featuring a hardware-encrypted Swipe solution, iProcess allows businesses to capture digital signatures and add tip amounts, if needed; geotag the location on a receipt; send receipts via email or SMS; add multiple MIDs inside the application; and perform full or partial refunds through the Transaction History Log.

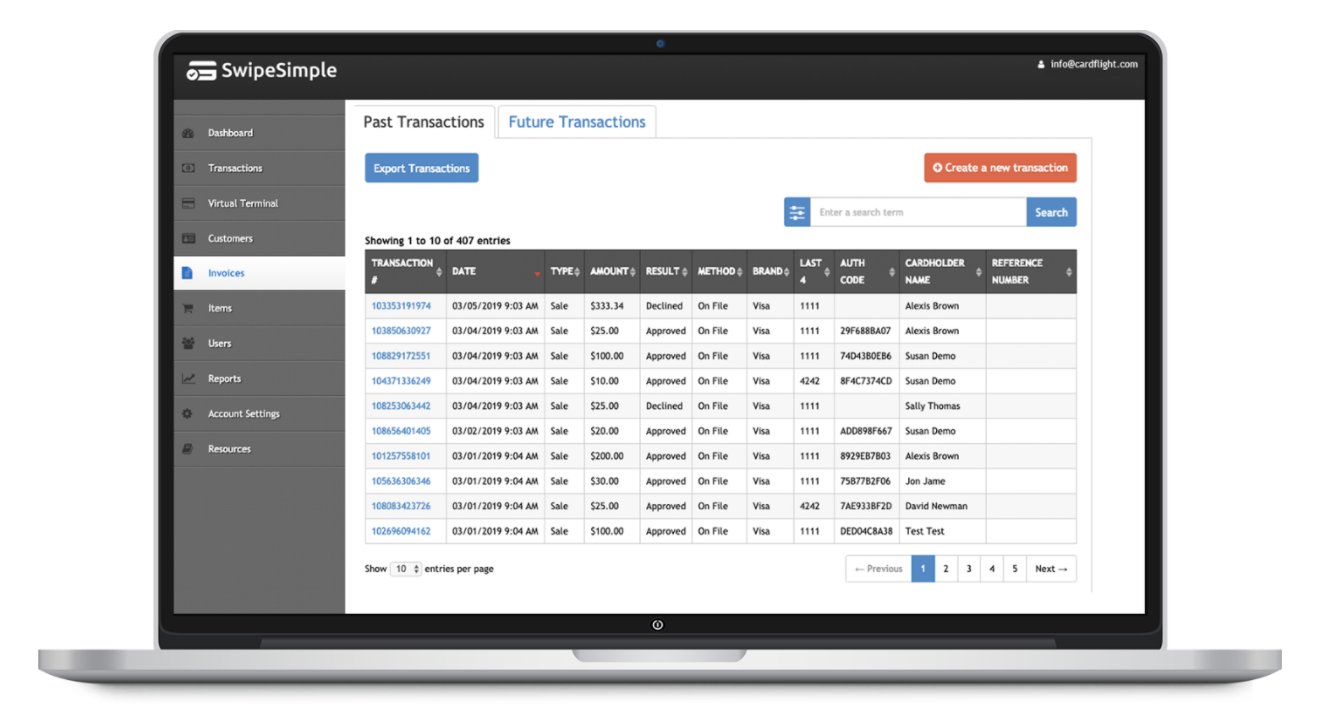

Electronic Invoicing enables merchants to invoice customers via email and allows customers to make payments by following an embedded link. Invoices are automatically converted into PDFs that are attached and sent to the customer’s email address.

This simple and intuitive software program allows businesses to streamline the billing process, which saves them time and allows them to get paid more quickly; save customer data securely without worrying about rigorous PCI compliance issues; accept full or partial payments; and maintain a more complete and secure recordkeeping system. In addition, Electronic Invoicing supports over 90 currencies.

The Clover Go is ideal for secure credit card swipes, dips and taps like Apple Pay. It provides a secure way to accept payments virtually anywhere, using a smartphone or tablet. Customers can pay using their mobile devices. Clover Go works with other Clover devices, which allows business owners to open an order from any other Clover POS and close it out on Clover Go. All transactions are secure and fully encrypted and the Tips & Taxes function allows merchants to set custom percentage amounts for tips and create multiple tax rates for the items they sell.

The Clover Flex accepts all payments — credit, debit, EMV chip cards, NFC payments, Apple Pay, Android Pay, gift cards and cash — as well as electronic signatures, emails and text receipts. In addition, all transactions are stored, saving the time and trouble of collecting paper receipts. The Clover Flex also features a built-in camera and barcode scanner, so all the items are scanned into the inventory instantly.

“These products will provide merchants the help they need to sustain cash flow during these difficult times,” said Chad Horal, President, MPBS. “These technologically advanced products will ensure their customer data and transaction histories are securely maintained and that they will be paid in a timely manner.”

For more information, call (800) 942-7970 or visit www.metrobps.com.